Compound interest calculator different annual contributions

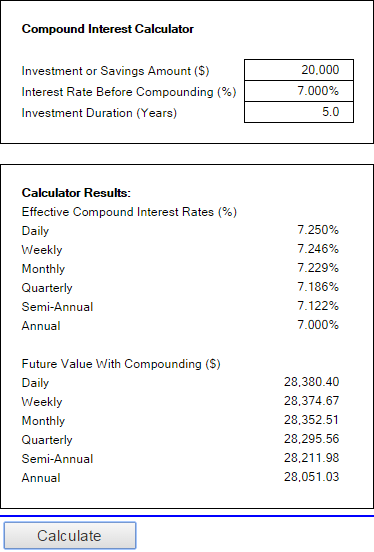

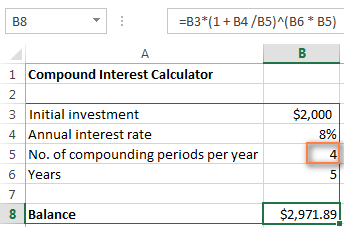

It can be handy to visualize compound interest by creating a simple model in Excel that shows the growth of your investment. Next well look at how to calculate compound interest at different frequencies for the same above example to see how it changes the outcome.

Compound Interest Formula And Calculator For Excel

Thats a few.

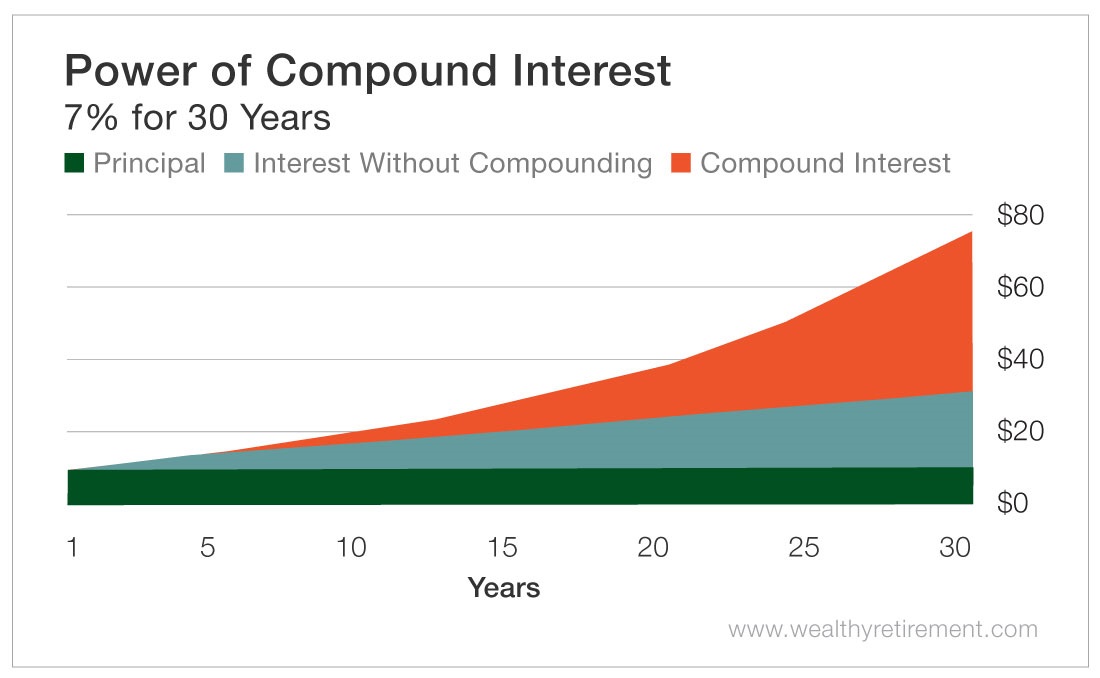

. To understand and compare the different ways in which interest can be compounded please visit our Compound Interest Calculator instead. It is the basis of everything from a personal savings plan to the long term growth of the stock market. Compound interest is different to simple interest in that you the saver will earn interest on interest.

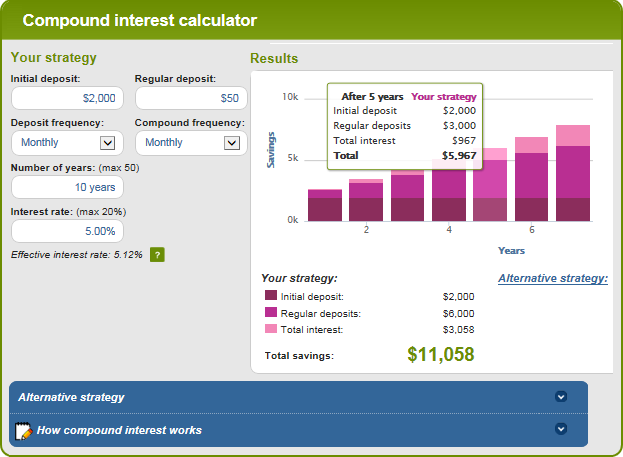

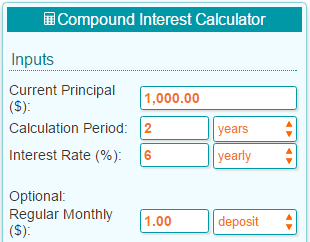

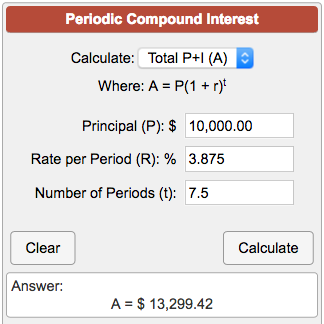

A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts. Over the same 4-year period if we choose to compound the initial 1000 investment quarterly or 16 times instead of four times over four years we end up with. This is your account balance at the amount you lend to the bank.

NPS Tier 1 accounts are the most basic form of NPS. To calculate interest with regular contributions begin with the accumulated savings formula and input your. Different 401k plans have different rules regarding vesting.

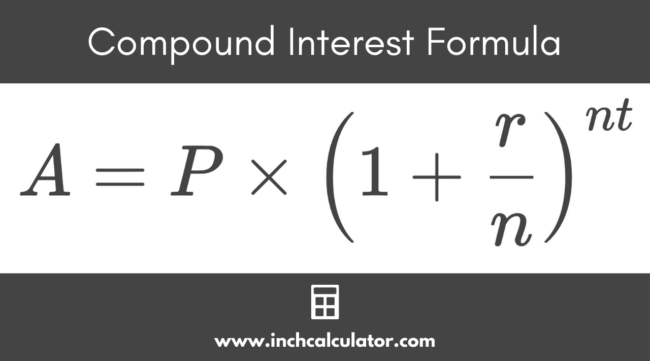

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Einstein referred to compound interest as the eighth wonder of the world. Annual Contributions Cumulative Contributions Interest Earned Cumulative Interest Total Balance.

For Monthly Contributions you will enter the amount that you plan to add to your dividend investment each month. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

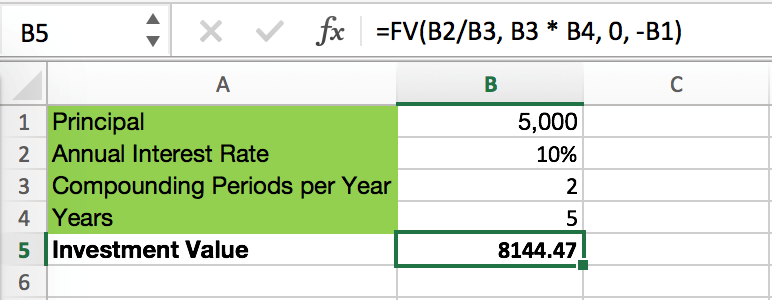

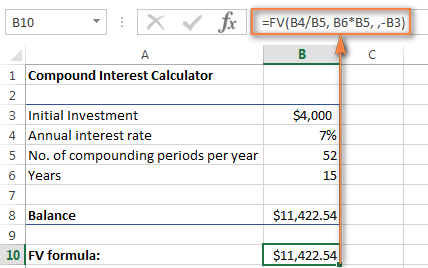

Both private and government employees can opt to invest in this retirement planning scheme. NPS State Government NPS Central Government NPS Corporate and NPS All Citizens. The detailed explanation of the arguments can be found in the Excel FV function tutorial.

Start by opening a document and labeling the top cell in columns A B and C Year Value and Interest Earned respectively. For example if you were to invest 5000 at an annual simple interest rate of 5 you would earn 250 each year. In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result.

As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded. NPS accounts come in different forms. The frequency of compounding and wealth accumulation are directly related.

Contributions and their subsequent interest earnings as part of a 401k plan cannot be withdrawn without penalty before the age of 59 ½. Similarly a higher annual compound interest rate implies higher returns. Thought to have.

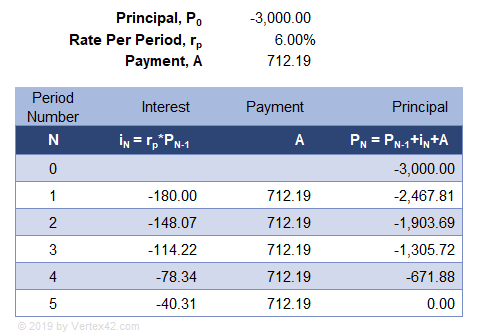

Enter the years 0-5 in cells A2. For example with an annual interest rate on a Certificate of Deposit of 2 and quarterly compounding the calculation is APY 1 0024 4 - 1 100 102015 4 - 1 100 102015 - 1 100 2015 annual percentage yield. This is the overall length of the loanYoull need to convert months to years for this variable.

After 10 years you would have amassed a total of. Years at a given interest. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate.

Lets look at the growth of INR 10000 at 10 compound interest compounded at different frequencies. This is the percentage that the account pays you. For more accurate information it is best to speak with human resources or 401k plan administrators.

This is useful for those who have the habit of saving a certain amount. Keep in mind. You can switch the view to see a comprehensive breakdown in.

You earn interest on top of interest. If people begin making regular investment contributions. This is how often the bank pays you interest yearly monthly or daily for example.

Using our retirement calculator. Include additions contributions to the initial deposit or investment for a more detailed calculation. Each month a fraction of the annual interest is calculated and added to your balance which in turn affects the following months calculation.

Plus you can also program a daily compound interest calculator Excel formula for offline use. See how much you can save in 5 10 15 25 etc. Use our compound interest calculator to see how your savings or investments might grow over time using the power of compound interest.

Our Interest Calculator above allows periodic depositscontributions. Making regular contributions to your account is one of the best ways to increase your income and receive compounding benefit over time. You can find many of these calculators online.

NPS Tier 1 accounts come in different forms. Your money earns interest every day if it compounds daily and then the next days interest is calculated based on THAT total instead of on the principal. Try using different numbers to see things like what your savings could be like if you changed your monthly contribution or wanted to retire earlier.

You and your employees are missing out on compound interest. Besides the missed. Use of a continuous compound interest calculator is among the various benefits of this strategy is the fact that it allows you to visualize investment horizons.

Where r is the simple annual interest rate in decimal n is the number of compounding periods per year. Annual Dividend Yield is a measure of the annual percentage paid by the security. The interest can be compounded annually semiannually quarterly monthly or daily.

Contact Paychex today to get started. Here are some examples of the same 10000 investment with fixed 5 annual interest but with different compounding frequencies. The Principle of Compound Interest.

The higher the frequency of compounding more the accumulation of wealth. Create an Excel document to compute compound interest. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings.

For instance many savings accounts quote an annual rate yet compound interest monthly.

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Calculator For Excel

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Calculator Daily Monthly Yearly

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compounding Interest Calculator Yearly Monthly Daily

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

How Do I Calculate Compound Interest Using Excel

Periodic Compound Interest Calculator

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Set Your Own Compounding Periods

Compound Interest Calculator Inch Calculator

Walletburst Compound Interest Calculator With Monthly Contributions

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator For Excel

Compound Interest Calculator With Formula